Nigeria’s Oil Output Rises to 1.7mbpd in April as New “Obodo” Crude Grade Debuts

Global Macro Highlights

US Headline Inflation (YoY)

According to the Bureau of Labor Statistics, U.S. headline inflation eased for the third consecutive month, moderating to 2.3% YoY in April (vs 2.4% YoY in March) — its lowest level since February 2021. The continued deceleration was primarily driven by a sustain decline in the energy index, which fell by 3.7% YoY (vs -3.3% YoY in March), reflecting subdued global oil prices during the period. Transport inflation also slowed to 2.5% YoY (vs 3.1% YoY), while food inflation edged down to 2.8% YoY (vs 3.0% YoY), largely due to a moderation in “food at home” costs (2.0% vs 2.4%). Core inflation remained sticky at 2.8% YoY. On a monthly basis, the Consumer Price Index (CPI) increased by 0.2%, rebounding from a 0.1% decline in March.

UK GDP Growth Rate (YoY)

According to preliminary estimates from the Office for National Statistics (ONS), the UK economy slowed to 1.3 YoY in Q1:2025, compared to 1.5% YoY in the previous quarter. This was driven by sustained contraction in industrial production (-0.2% YoY vs -1.1% YoY), slower household (-0.7% YoY vs 1.2% YoY) and government spending (1.3% YoY vs 2.6% YoY). However, gross fixed capital formation accelerated significantly, (4.4% YoY vs 2.2% YoY), driven largely by a surge in business investment (8.1% YoY vs 1.8% YoY). Exports declined marginally by 0.3% (vs -3.5%), while imports saw a sharp increase of 7.6% (vs 5.0%). On a quarterly basis, GDP grew by 0.7%, the strongest performance in three quarters.

Eurozone GDP Growth Rate (QoQ)

According to Eurostat, the Eurozone economy expanded by 0.3% QoQ and 1.2% YoY in Q1:2025, marking the fifth consecutive quarter of growth. However, the quarterly growth figure came in slightly below the preliminary estimate of 0.4%. Within the bloc, performance was mixed. Germany returned to growth at 0.2% QoQ following a contraction in Q4:2024, aided by recent fiscal reforms, while Ireland led growth with a 3.2% QoQ expansion. Conversely, Slovenia’s GDP fell by 0.8% QoQ. Despite the continued expansion, the pace of growth remained modest, reflecting lingering softness in domestic demand and early signs of external headwinds.

Japan GDP Growth Rate (YoY)

Japan’s economy contracted by 0.7% YoY in Q1:2025, while on a quarterly basis, GDP dipped by 0.2% QoQ, underpinned by subdued private consumption and a significant drag from external trade. The downturn was driven by stagnant private consumption (+0.00% QoQ) – which accounts for over 50% of GDP and a sharp drag from net exports, as rising imports (+2.9% QoQ) outpaced exports (-0.6% QoQ), even in the face of the full impact of U.S. tariff hikes took effect.

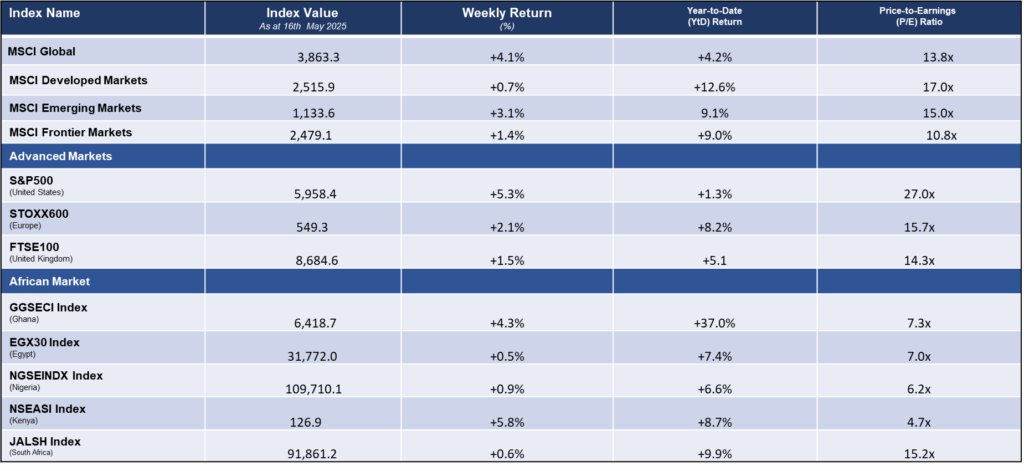

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Events

Nigeria’s Inflation Eases to 23.7% in April, Driven by Slower Food Prices

According to the National Bureau of Statistics, Nigeria’s headline inflation eased to 23.7% YoY in April 2025 (vs 24.23% YoY in March). This deceleration was primarily driven by sustained moderation in food inflation, which slowed for the fourth consecutive month to 21.3% YoY. Core inflation also edged lower to 23.4% YoY, supported by tempered price pressures in clothing, health, and transport categories. On a monthly basis, inflation printed at 1.9% MoM (March: 3.0%), as food inflation decelerated to 2.01% MoM despite seasonal pressures from Ramadan and Easter festivities, while core inflation also moderated to 1.3% MoM.

CBN Launches NRBVN Platform to Boost Remittances and Deepen Diaspora Engagement

The Central Bank of Nigeria (CBN), in partnership with the Nigeria Inter-Bank Settlement System (NIBSS), has launched the Non-Resident Bank Verification Number (NRBVN) platform. This development aligns with the apex bank’s broader agenda to expand financial access and deepen diaspora engagement. The NRBVN platform launch comes on the back of improved formal remittance inflows, which rose to USD4.7bn in 2024 (vs USD3.3bn in 2023), supported by FX market liberalization. With this innovation, the CBN targets monthly inflows of USD1.0bn, alongside lower remittance costs and increased diaspora-linked investment activities.

Nigeria’s Oil Output Rises to 1.7mbpd in April as New “Obodo” Crude Grade Debuts

According to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Nigeria’s oil production (including condensates) rose by 15.9% YoY to 1.7mbpd in April 2025, from 1.5mbpd in April 2024. The growth was driven by a 15.5% YoY increase in crude oil output to 1.5 mbpd and a 19.2% YoY rise in condensate production to 197,607 bpd. On a MoM basis, production improved by 5.0% from 1.6mbpd in March 2025, marking the first monthly increase after two consecutive months of declines. In a strategic move to strengthen its position in the global crude market, Nigeria also launched a new crude oil grade, “Obodo”,through a cargo lifted by the TotalEnergies-NNPC Ltd joint venture.

Access Holdings Pauses Expansion to Consolidate Landmark Acquisitions Across Africa

On the corporate scene, Access Holdings Plc (ACCESSCORP) announced a strategic shift in its growth trajectory, signaling a temporary slowdown in expansion activities as it focuses on consolidating recent acquisitions. The decision follows a series of significant acquisitions in 2024, including African Banking Corporation of Tanzania, Afrasia Bank (Mauritius), and Standard Chartered’s operations in Angola and Sierra Leone. In addition, the bank entered into binding agreements to acquire Bidvest Bank (South Africa) and National Bank of Kenya—both transactions currently at various stages of regulatory approval and closure.

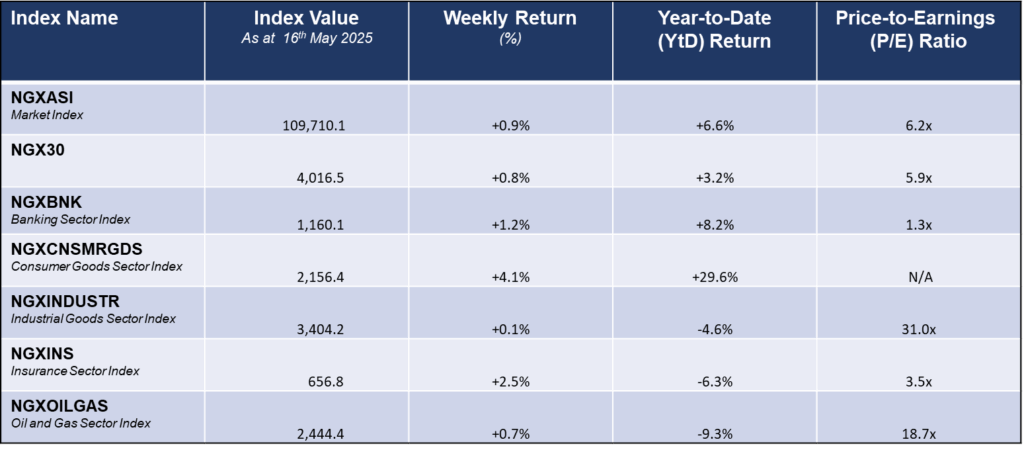

Equities Market – Sectorial Performance

Weekly Performance of Sectorial Indices

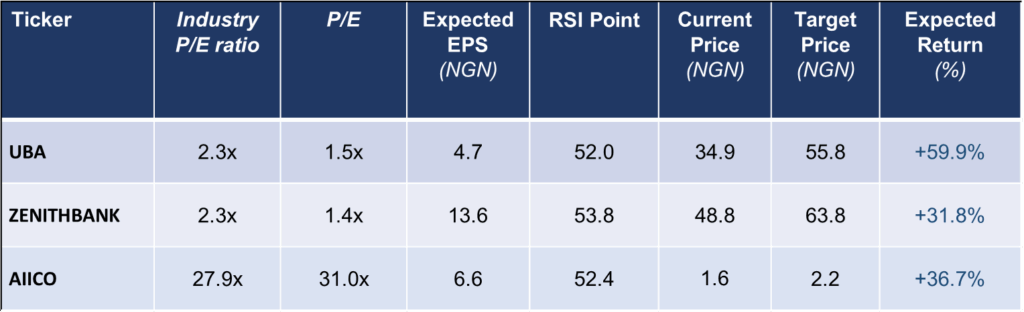

Stock Picks for the Week

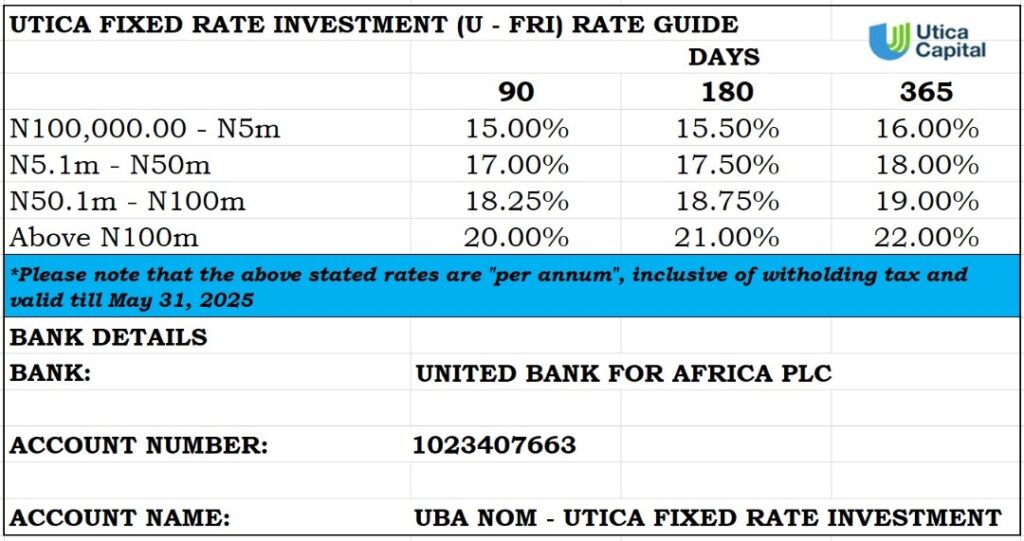

Fixed Income Opportunities for the week