Global Macro Highlights

The US economy expanded at an annualized rate of 3.20%

According to data from the Bureau of Economic Analysis, the US economy expanded at an annualized rate of 3.20% in Q4:2023, slightly below the 3.30% initially reported in the advance estimate. This downward revision aligns with our forecast of slower growth for advanced economies in 2024 due to factors such as high interest rates, supply chain disruptions, and ongoing geopolitical tensions.

Eurozone Manufacturing PMI for February 2024 according to S&P Global rose to 46.50pts

the Eurozone Manufacturing PMI for February 2024 according to S&P Global rose to 46.50pts, exceeding the initial estimate of 46.10pts. Despite the upward revision, the PMI remained slightly below January’s 10-month high of 46.60pts, signaling an ongoing decline in manufacturing activities. We attribute this trend to the elevated interest rates in the region, which have limited production activities, particularly in manufacturing.

Country Garden, which defaulted on a USD500.0mn debt last year

A major player in the Chinese property sector, Country Garden, which defaulted on a USD500.0mn debt last year, has received a liquidation petition from a creditor after defaulting on another USD204mn loan. This indicates a potential trigger which could escalate the ongoing crisis in the Chinese property sector. With the property sector’s significance to China’s economy, an escalation could further dampen growth prospects,).

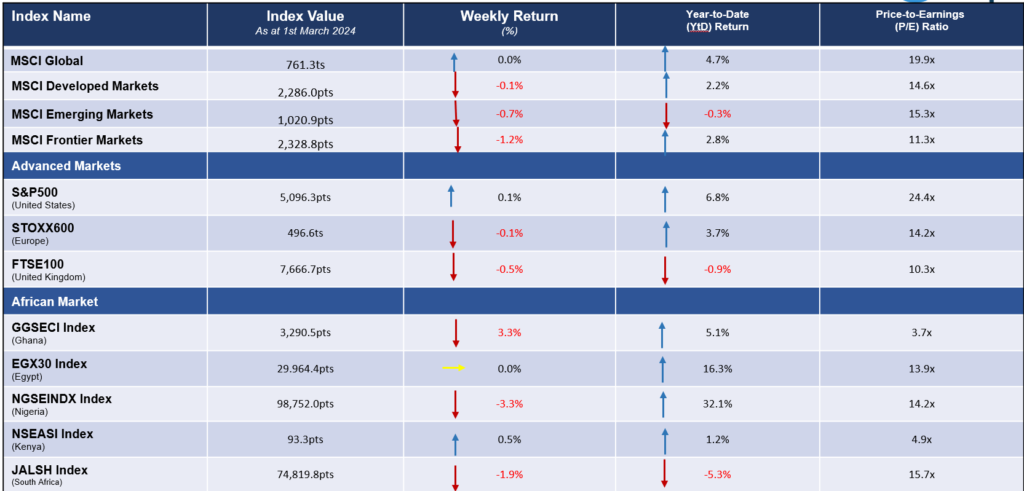

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Updates

MPC in an effort to maintain price stability, implemented a 400bps increase in the MPR

The Monetary Policy Committee (MPC) in an effort to maintain price stability, implemented a 400 basis points (bps) increase in the Monetary Policy Rate (MPR) to 22.75% at its last meeting, marking the highest rate hike pace in history. Also, the committee raised the Cash Reserve Ratio (CRR) by 1250bps to 45.0% and adjusted the lower band of the asymmetric corridor to -700bps around the MPR from -300bps around the MPR, while maintaining the liquidity ratio at 30%. We expect the MPC’s decision to potentially curb money supply and taper system liquidity, while enhancing the country’s foreign exchange dynamics.

CBN announced its decision to sell foreign exchange worth USD20,000 to eligible BDC operators across the country

The Central Bank of Nigeria (CBN) announced its decision to sell foreign exchange worth USD20,000 to eligible Bureau De Change (BDC) operators across the country. The allocation is to be sold at the rate of NGN1,301.0/USD, representing the lower band rate of executed spot transactions at NAFEM for the previous trading day. Also, all BDCs are allowed to sell to end-users at a margin not more than 1.00% above the purchase rate from the CBN. In our view, this move aligns with the apex bank’s policy measures aimed at enhancing liquidity in the country’s foreign exchange market and stabilizing the Naira.

The CBN also revoked the licenses of 4,173 BDCs during the week

The CBN also revoked the licenses of 4,173 BDCs during the week. The apex bank cited failure by the affected BDCs in observing at least one of the stipulated regulatory provisions. With this move, there will now be 1517 operational BDCs from the initial 5,690. We expect this move to further enable the CBN fund the operational BDCs and effectively ensure regulatory compliance in the FX market.

FEC has granted approval for the implementation of the Orosanye Report

The Federal Executive Council (FEC) has granted approval for the implementation of the Orosanye Report. This adoption is expected to lead to significant restructuring within the government, with the dissolution of certain agencies, commissions, and departments. In our view, this initiative could effectively reduce the cost of governance, potentially decrease the budget deficit, and ultimately enhance the efficiency of government operations.

Transcorp Group is set to list its shares on the NGX on the 4th of March 2024

On corporate action, Transcorp Power, a member of the Transcorp Group is set to list its shares on the NGX on the 4th of March 2024. The company aims to offer 7.5bn units of shares at 50 kobo each, at a listing price of NGN240.0 per share. Thus, bringing the company’s expected market capitalization to around NGN1.8trn. We expect this move to drive the group’s strategic growth trajectory and spur development in the power sector.

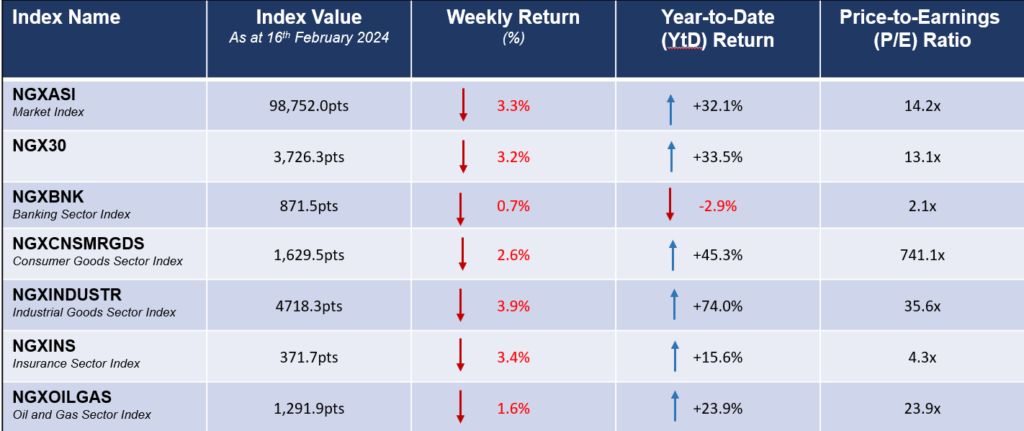

Equities Market – Sectorial Performance

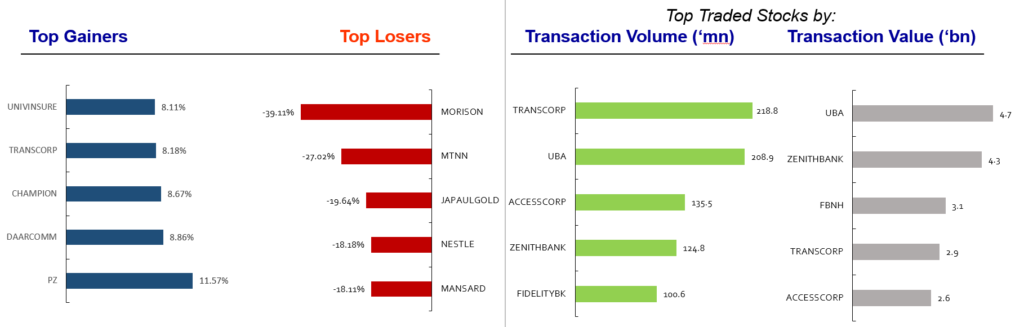

Summary of Equities Transactions

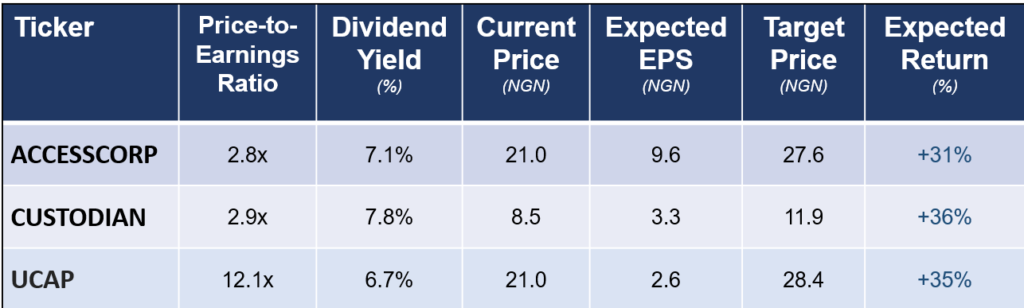

Stock Picks for the week

Utica Fixed Deposit Investment