Global Macro Highlights

The Bureau of Labor Statistics revealed that the U.S. inflation rate decelerated in January 2024

The Bureau of Labor Statistics revealed that the U.S. inflation rate decelerated in January 2024 to 3.1% YoY, from 3.4% YoY recorded in December 2023. This was however higher than the estimated 2.9% for the period. This downtrend in inflation can be attributed to lower food and energy prices during the period with food inflation falling to 2.6% YoY (vs. 2.7% YoY in December 2023). The data also revealed that the core index which excludes farm produce and energy remained unchanged at 3.9% YoY from the previous period.

Japan’s economy recorded a second consecutive quarter of negative growth

Similarly in Asia, Japan’s economy recorded a second consecutive quarter of negative growth as the country’s GDP contracted by 0.4% YoY in Q4:2023 and a decline of 3.3% YoY In Q3:2023. This decline is owed to the impact of weaker demand stemming from lower consumer spending, and weaker currency during the period. We expect this to further delay the Bank of Japan’s (BoJ) imminent decision to increase interest rate for the first time since 2007 as the bank has been maintaining low interest rates low aimed at spurring domestic demand.

UK GDP contracted for the second consecutive quarter in Q4:2023 by 0.3%

Meanwhile, according to data from the Office for National Statistics (ONS), the UK GDP contracted for the second consecutive quarter in Q4:2023 by 0.3%, following a decline of 0.1% in Q3:2023. Thus, indicating that the region has slipped into a recession for the first time since 2020. In our view, the negative economic growth was driven by the impact of the higher interest rate environment and elevated inflation during the period which has caused a drag on economic activities.

Ghana’s headline inflation increased marginally to 23.5% in January 2024

In Sub-Saharan Africa, Ghana’s headline inflation increased marginally to 23.5% in January 2024 from 23.2% recorded in December 2024. This acceleration follows six consecutive months of disinflation after reaching a record high of 54.1% in January 2023. The primary driver of the uptrend is core inflation, which increased to 20.5% from 18.7% recorded in December, while food inflation cooled to 27.1% from 28.7% in December, primarily due to lower food and energy prices.

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Updates

According NBS Nigeria’s headline inflation increased for the thirteenth consecutive month

According to data released by the National Bureau of Statistics (NBS), Nigeria’s headline inflation increased for the thirteenth consecutive month to 29.90% YoY in January 2024 (compared to 28.92% YoY in December 2023), reaching its highest level in 28 years. This uptick in inflation was primarily driven by higher food prices, with the food index surging to 35.41% YoY. Additionally, the core index rose to 23.59%, driven by higher prices of passenger transport and increased prices of import dependent items.

CBN directed all authorized dealer banks to disburse PTA and BTA

In a circular issued on February 15, the Central Bank of Nigeria (CBN) directed all authorized dealer banks to disburse Personal Travel Allowance (PTA) and Business Travel Allowance (BTA) exclusively through electronic means, discontinuing cash payments. This directive is seen as a measure to enhance transparency and stability in the foreign exchange market, while also aiming to curb forex malpractices.

The CBN has mandated all authorised banks to limit the initial repatriation of export proceeds

Also, the CBN has mandated all authorised banks to limit the initial repatriation of export proceeds to the parent accounts of International Oil Companies (IOCs) operating in Nigeria to 50% of the total amount. The directive further instructed that the remaining 50% should be pooled gradually over a 90-day period from inflow date of the export proceeds. While we note that this move may sway the confidence of IOCs from operating in the country, we posit that the initiative will help spur FX liquidity and cushion volatility in the FX market in the near term.

Equities Market – Sectorial Performance

Summary of Equities Transactions

Stock Picks for the week

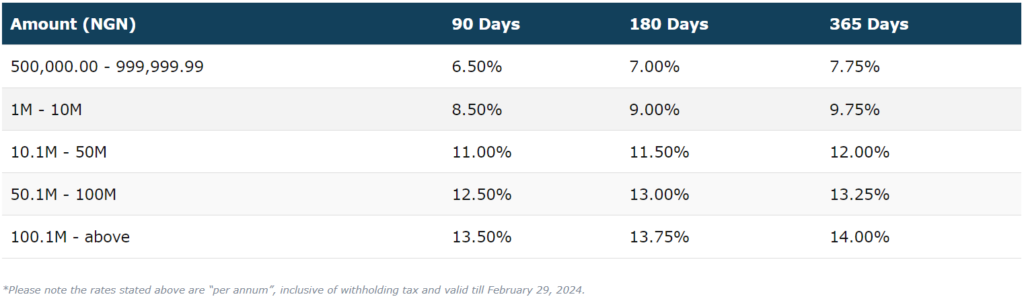

Utica Fixed Deposit Investment