Global Macro Highlights

US Fed have decided to maintain its key interest constant at a 23 year high of 5.25% to 5.50%

In the US, the Federal Reserve (US Fed) have decided to maintain its key interest constant at a 23 year high of 5.25% to 5.50% at its last monetary policy meeting citing that previous interest rate hikes exercises have significantly influenced demand and reduced inflationary pressure in the country. Looking ahead, we expect the committee to keep rates constant while monitoring underlying factors that threaten price stability, such as labour market trends and supply chain disruptions stemming from the ongoing geopolitical tensions in the Middle East.

Hong Kong court has issued an order for the liquidation of Evergrande Group

In Asia, a Hong Kong court has issued an order for the liquidation of China’s property giant Evergrande Group following the failure of the company ‘s debt restructuring plans. This directive comes two years after Evergrande defaulted on its debt, creating a ripple effect in the Chinese property sector and impacting the country’s economy. While this may instil weaker confidence in the property sector, we expect some clarity and a more structured revitalization effort by the Chinese government.

BOE also left its policy rate unchanged

Similarly, the Bank of England (BOE) also left its policy rate unchanged at its latest policy meeting seeing that inflation has continued to decelerate and closer to the BOE’s inflation target of 2%. They also mentioned the possibility of keeping interest rate elevated for a longer period of time, until risks of unexpected increases in inflation dissipates. Coupled with the surprise jump in inflation in December, we expect the BOE to keep watch on possible inflation drivers before deciding to cut rates in the latter parts of the year.

The International Monetary Fund (IMF) has increased its 2024 projection for global growth to 3.10%

The International Monetary Fund (IMF) has increased its 2024 projection for global growth to 3.10%, up 0.2% from the initial forecast in October 2023. The improved outlook is based on the US economy’s greater-than-expected resilience and fiscal support’s positive impact on the Chinese economy. Contrary to the sub-Saharan region, the 2024 outlook was revised downward to 3.80% from 4% owing to weaker projections from its major economies -South Africa and Nigeria

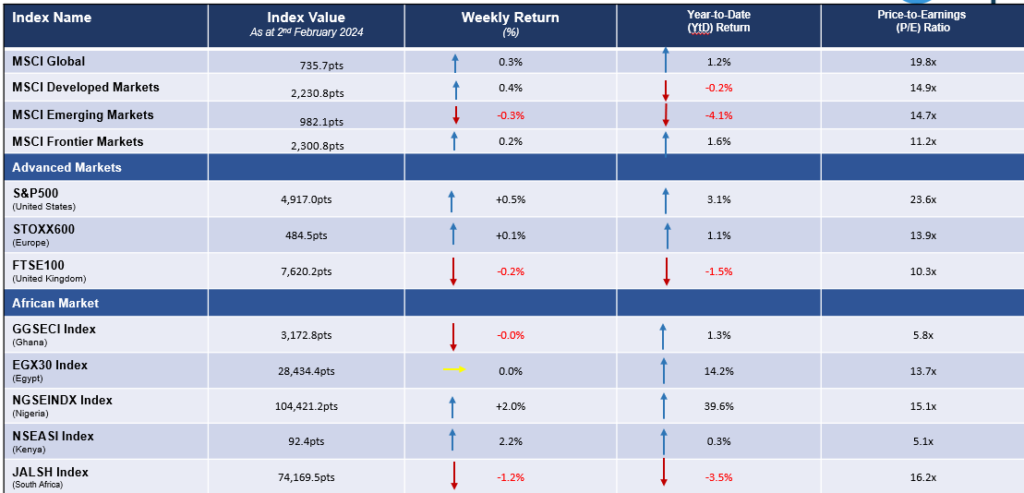

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Updates

The Central Bank of Nigeria (CBN) issued a regulatory directive to all commercial banks

The Central Bank of Nigeria (CBN) issued a regulatory directive to all commercial banks, which imposes stringent limits on the Net Open Position (NOP) of Nigerian banks regarding their foreign currency exposures, both on and off the balance sheet. This mandates banks to adhere to a strict cap on the NOP, restricting it to a maximum of 20% short position or 0% long position of shareholders’ funds unimpaired by losses, determined by the Gross Aggregate Method.

CBN announced the cessation of indiscriminate daily Cash Reserve Ratio (CRR) debits for banks

Similarly, in a recent communication, the CBN announced the cessation of indiscriminate daily Cash Reserve Ratio (CRR) debits for banks. Instead, a different approach will be implemented, involving CRR debits set at 32.5% and 10% for commercial banks and merchant banks, respectively. This will be applied to increments in a bank’s weekly adjusted deposits. Additionally, banks falling below the loan-to-deposit ratio (LDR) threshold of 65% will face a CRR levy equivalent to 50% of the subsequent deficit.

The CBN eliminated initial exchange rate limits for International Money Transfer Operators (IMTOs)

In its bid to enhance the foreign exchange market, the CBN eliminated initial exchange rate limits for International Money Transfer Operators (IMTOs). Alongside this, the CBN has raised the IMTOs license application fee from NGN500,000 to NGN10mn with evidence of tax clearance and incorporation documents. Furthermore, foreign companies now face a minimum operating capital requirement of USD1mn, with an equivalent in naira for domestic IMTOs. These changes reflect the CBN’s firm commitment to reforming and stabilizing Nigeria’s foreign exchange landscape.

The IMF revised downward its 2024 economic growth projection for Nigeria to 3.0% from the 3.1%

In its recently released World Economic Outlook Update for January 2024, the International Monetary Fund revised downward its 2024 economic growth projection for Nigeria to 3.0% from the 3.1% it forecasted in October, hinged on weaker oil and gas production. Nigeria heavily relies on oil revenue, and any decline in production can strain fiscal and economic stability. The downgrade underscores the need for Nigeria to address structural issues and be more efficient at rectifying issues surrounding its oil and gas sector.

Airtel Africa Plc (AIRTELAFRI) announced plans for a USD100mn share buy-back program

On the corporate scene, Airtel Africa Plc (AIRTELAFRI) announced plans for a USD100mn share buy-back program. Pending regulatory approval, the program is slated to commence in March 2024, spanning over a 12-month period. Aligned with the company’s optimistic long-term outlook, the buy-back will be funded through its existing cash reserves.

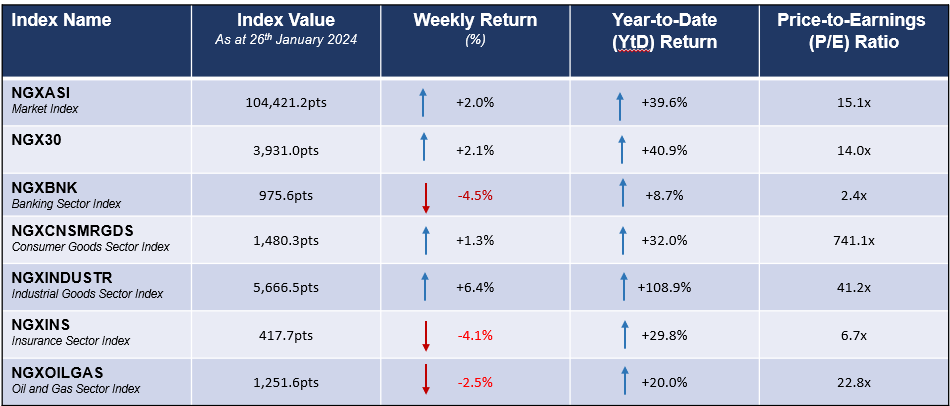

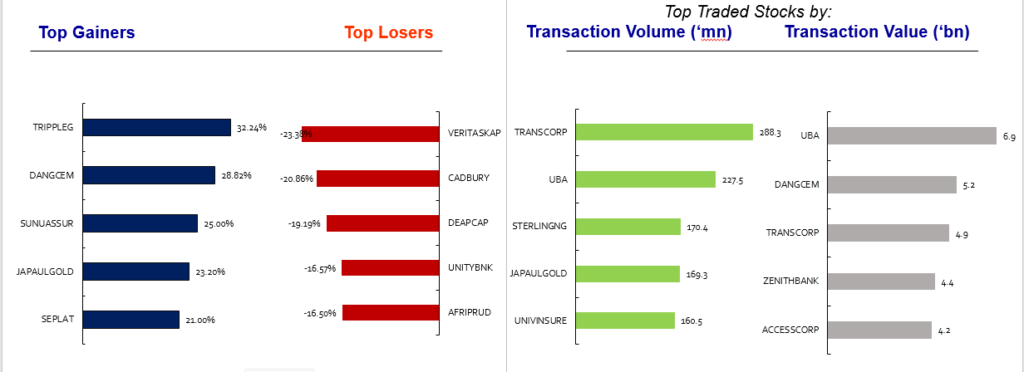

Equities Market – Sectorial Performance

Summary of Equities Transactions

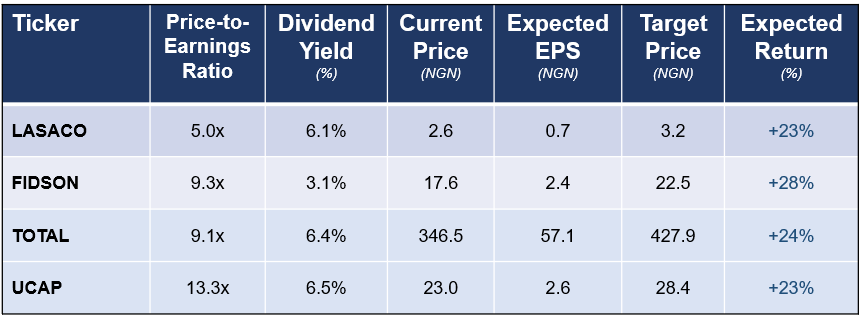

Stock Picks for the week

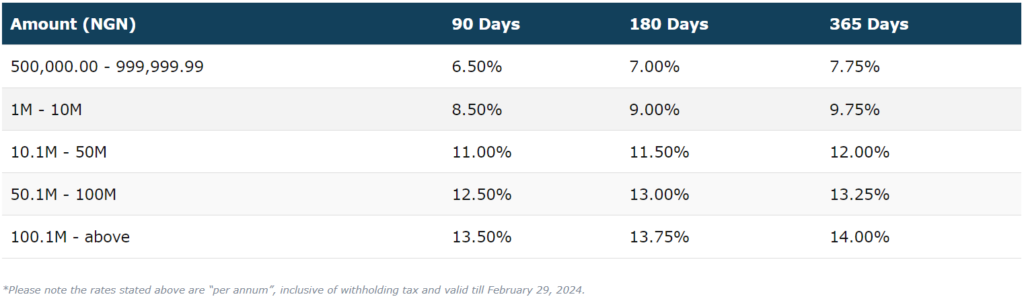

Utica Fixed Deposit Investment