Global Macro Highlight

U.S. economy grew by an impressive 4.9% YoY

According to a report by the United States Bureau of Economic Analysis, the U.S. economy grew by an impressive 4.9% YoY and 1.2% QoQ, representing the most substantial growth observed since Q4:2021. This surge was driven by increased government and consumer spending (a result of higher manufacturing, retail trade, and wages), along with growth in private inventory investment and exports. We opine that the economy’s resilience despite rate hikes by the Fed may prompt further rate adjustments for price stability.

ECB held its benchmark interest rate at 4.5%

In its recent policy meeting, the European Central Bank (ECB) held its benchmark interest rate at 4.5%, ending a streak of 10 consecutive rate hikes that started in July 2022, and totaling a 450bps increase. The decision was influenced by a drop in inflation from 5.20% in August 2023 to 4.30% in September, weaker-than-expected regional economic growth, and high borrowing costs affecting the economy. We anticipate that this move will stabilize borrowing costs (particularly for businesses), bolster business activities and consumer spending, which is crucial amid Germany’s sluggish economic growth.

South African Inflation Trends and the Central Bank’s Policy Outlook

The Bank of Canada decided to maintain its key interest rate at 5.0% after ten consecutive hikes, noting that there is now clearer evidence that its monetary policy is effective. This action trails a decrease in the country’s inflation rate to 3.8% YoY in September, down from 4.0% YoY in August, primarily driven by reduced prices for durable goods, groceries, and travel-related services. While the committee has chosen a wait-and-see approach with the current rate, the central bank remains watchful and open to potential future rate increases depending on the direction of the country’s inflation.

The World Bank has approved a USD1.0bn DPL to South Africa

In Sub-Saharan Africa, the World Bank has approved a USD1.0bn Development Policy Loan (DPL) to South Africa to address its energy crisis that has escalated to a critical point this year, leading to severe electricity blackouts. We consider the World Bank’s loan to be a substantial step toward resolving South Africa’s pressing energy shortfall, a crucial element for the country’s economic development. Moreover, this financial support is geared towards promoting long-term energy security and facilitating South Africa’s transition towards a just and low-carbon economy.

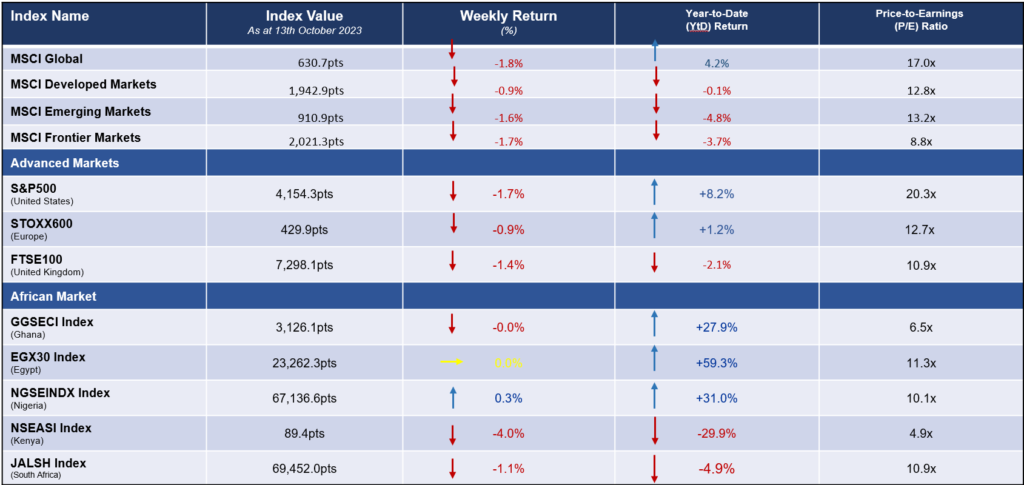

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Updates

The Federal Government of Nigeria has effectively invalidated the USD11.0bn

In a verdict delivered by the Business and Property Court in London, the Federal Government of Nigeria has effectively invalidated the USD11.0bn damages claim filed against it by Process and Industrial Development Ltd (P&ID) in connection with the failed gas processing agreement from 2011. The London court revoked the enforcement of the USD11.0bn arbitration award, citing that the awards were obtained through fraudulent means and that the procurement process violated public policy We view this ruling a positive development, particularly in light of Nigeria’s financial constraints and limited external reserves.

The reclassification of the MSCI Nigeria Indexes in a single step from Frontier Markets to Standalone Markets status

MSCI Inc., a leading provider of essential decision support tools and services for the global investment community, has announced the reclassification of the MSCI Nigeria Indexes in a single step from Frontier Markets to Standalone Markets status during the February 2024 Index Review, attributing this decision to ongoing liquidity challenges in the Nigerian foreign exchange market. According to MSCI, these FX issues have worsened the ease of capital repatriation, impeded access to the Nigerian equity market and hindered the replicability and investability of the MSCI Nigeria Indexes, leading to the decision to reclassify. In our assessment, though the reclassification is set to take effect next year, its timing following the recent FTSE Russell downgrade sends an adverse signal to international investors. This is expected to further undermine investor confidence and, subsequently, deter foreign investments in the country.

The consumer goods sector delivered mixed results

As the 9M:2023 earnings season commenced, performance varied across sectors. The consumer goods sector delivered mixed results, with some reporting losses due to FX exposure while others achieved robust earnings. In contrast, the banking sector generally performed well, as the banks continued to capitalize on FX market liberalization and revaluation gains. In the oil sector also, performance was positive as companies reported increased revenue from petroleum products, driving profit after tax.

At the T-bills primary market auction, the total subscription increased to NGN638.1bn At the T-bills primary market auction held during the week, the total subscription increased to NGN638.1bn from NGN321.1bn in the previous auction, leading to higher average stop rates of 5.9%, 9.0%, and 13.0% for the 91-day, 182-day, and 364-day instruments, up from 3.7%, 5.1%, and 9.3% in the previous auction, respectively.

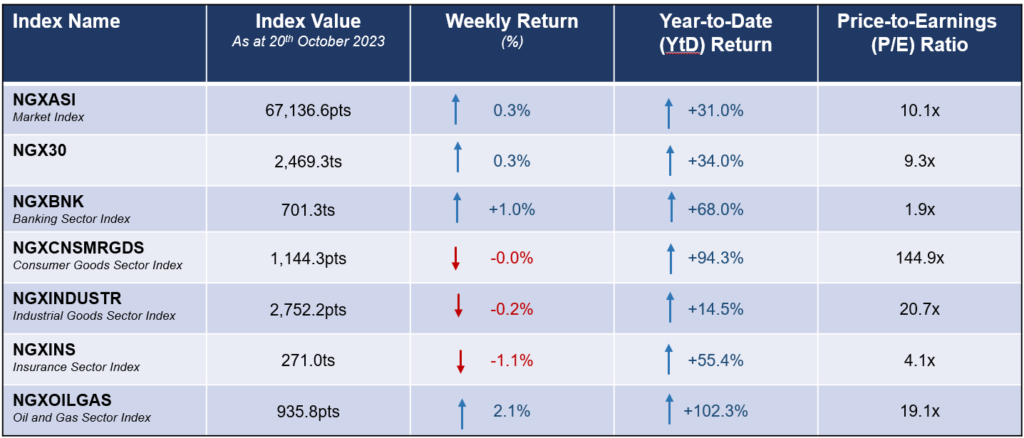

Equities Market – Sectorial Performance

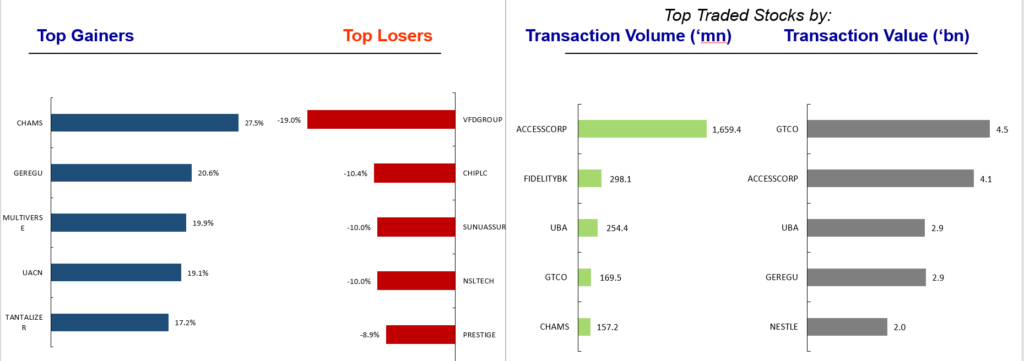

Summary of Equities Transactions

Stock Picks for the week

Utica Fixed Deposit Investment